Manufactured Freedom and the Myth of Choice

Founder & CEO of Stars and Rights, Shakil Ahmad, shares his op-ed in New Age Bangladesh on how freedom and choice are often manufactured to sustain inequality.

To house the articles on everything else

Founder & CEO of Stars and Rights, Shakil Ahmad, shares his op-ed in New Age Bangladesh on how freedom and choice are often manufactured to sustain inequality.

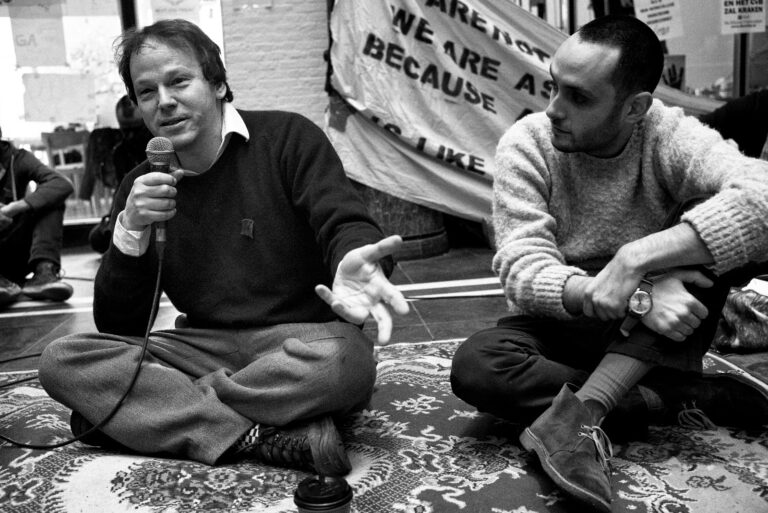

In 2014, something extraordinary happened that most people completely missed. The Bank of England - one of the world's most powerful financial institutions - quietly published a statement that destroyed everything we thought we knew about money.

"Most of the money in circulation is created, not by the printing presses of the Bank of England, but by the commercial banks themselves," they admitted. "Banks create money whenever they lend to someone in the economy."

For anthropologist David Graeber, author of "Debt: The First 5000 Years," this was like watching the emperor finally admit he had no clothes. After a century of economists telling us that money evolved from ancient barter systems, and that banks simply lend out money that savers deposit with them, even the banks themselves were now saying: "Actually, we just create money out of thin air."

But Graeber's book reveals something far more disturbing than just academic lies about economics. He shows how our entire global system runs on a simple principle: behind every dollar, every loan, every debt, there's ultimately violence. As he puts it, "Behind the wizard, there's a man with a gun."

From Nixon's 1971 decision to abandon the gold standard (to pay for bombing Vietnam) to the tragic collapse of Bangladesh's microcredit dream, from America's 800 military bases enforcing dollar dominance to the moral transformation that makes us see debt as sin - Graeber traces 5,000 years of how the powerful have used debt to control the powerless.

His conclusion? The system that's destroying our planet and trapping billions in poverty isn't natural or inevitable. It's a human creation. And humans can create something different.

The question isn't whether change is coming - the current system is already collapsing under its own contradictions. The question is: what will replace it? And do we have the courage to imagine a world where, as Graeber writes, "no one has the right to tell us what we truly owe"?

This is more than just economics. It's about what it means to be human in a world built on debt.

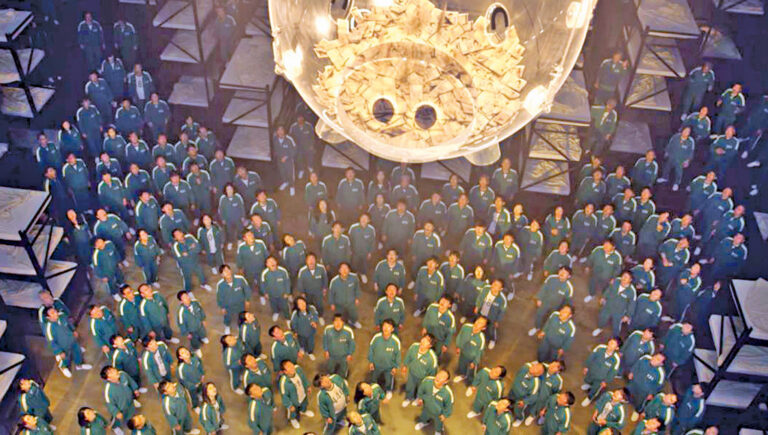

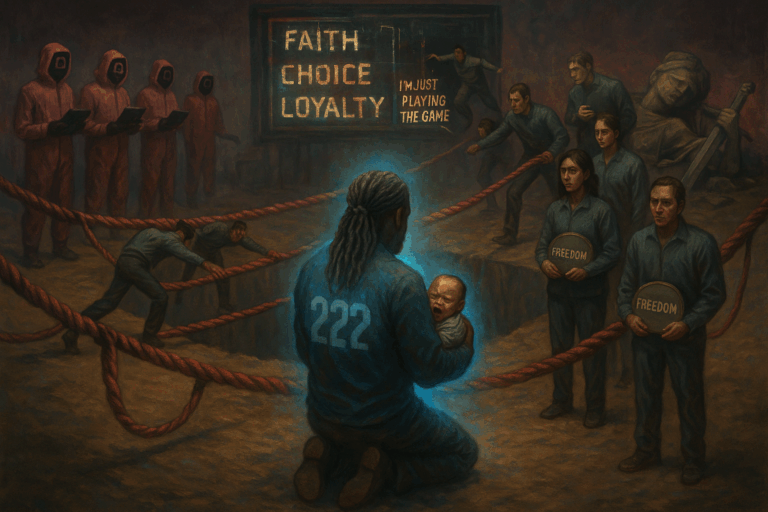

In the final chapter of The Game Is Rigged, we explore how Squid Game Season 3 confronts not just systems of oppression, but the people who sustain them. From mothers forced to play in the name of love, to survivors turned enforcers, this season reveals how power survives through internalized rules and moral illusions. But in the end, a single irrational act — compassion without reward — breaks the game’s logic. This is not just about Squid Game. It’s about us.

যখন আপনি জানেন যে সিস্টেমটা ভাঙা… তবুও আপনি আবার খেলতে ফিরে যান — কেন?

Squid Game সিজন ২-এ খেলোয়াড়েরা ফিরে আসে সেই গেমে, যার নির্মম বাস্তবতা তারা আগেই দেখে এসেছে। এই লেখায় বিশ্লেষণ করা হয়েছে, কেন কেবল সত্য জানা যথেষ্ট নয় — এবং কীভাবে পুঁজিবাদ আমাদের শিখিয়ে দেয় বিশ্বাস করতে, নীরব থাকতে, আর শোষণকেই "মুক্তি" মনে করতে।

হা-জুন চ্যাং-এর ২৩টি অজানা কথা বইয়ের আলোকে এই ব্লগপোস্টে খোঁজ করা হয়েছে বিশ্বাস, আত্মসমর্পণ এবং সেই কঠিন প্রশ্নগুলো — যেগুলো জিতেও মানুষকে বন্দী করে রাখে।

What happens when you know the system is broken… but you keep playing anyway?

In Squid Game Season 2, players return to the game even after seeing the truth. This post explores why awareness alone isn’t enough to escape — and how capitalism conditions us to mistrust whistleblowers, justify cruelty, and call exploitation “freedom.”

Inspired by Ha-Joon Chang’s 23 Things They Don’t Tell You About Capitalism, this second article unpacks belief, complicity, and the corruption of survival in a system that demands silence over change.

স্কুইড গেম যেন একটি নির্মম প্রশ্ন করে আমাদের কাছে—

আমরা কীভাবে সহিংসতা ও নিপীড়ন মেনে নিই, যদি কেউ “নিজের ইচ্ছায়” তাতে অংশ নেয়?

এই ব্লগপোস্টে বিশ্লেষণ করা হয়েছে সাতটি দৃশ্য, যেখানে স্কুইড গেম-এর প্রতিটি খেলা বাস্তব জীবনের পুঁজিবাদী ফাঁদগুলোর প্রতিচ্ছবি।

পাশাপাশি হা-জুন চ্যাং-এর “২৩টি অজানা কথা” বইয়ের কিছু অধ্যায় তুলে ধরা হয়েছে—যা দেখায়, বাজার আসলে কখনোই মুক্ত নয়, এবং ‘পছন্দ’ অনেক সময়ই ছদ্মবেশী বাধ্যবাধকতা।

What if the greatest trick capitalism ever pulled was convincing us that our suffering was our own fault?

In Squid Game, 456 people "choose" to compete for survival. But what they’re really choosing is a system that was never built for them to win. The show doesn’t just critique inequality — it confronts something darker: our tendency to justify cruelty as long as it’s wrapped in the language of consent.

“They signed up. They knew the risks.”

We say that about the show’s players. But we also say it about gig workers, debt-ridden students, sweatshop laborers — anyone crushed under an economy that claims to offer freedom but delivers desperation.

This blog post unpacks seven moments from Squid Game that mirror real-world economic traps — and ties them to the uncomfortable truths Ha-Joon Chang reveals in 23 Things They Don’t Tell You About Capitalism.

If you've ever wondered why the game feels familiar, this is your answer.